County law forcing upgrade of former foreclosed properties is proposed

Date: Oct 08, 2018 10:05 AM

County law forcing upgrade of former foreclosed properties is proposed

Warren County Tax Auction set for Oct. 20

by Thom Randall

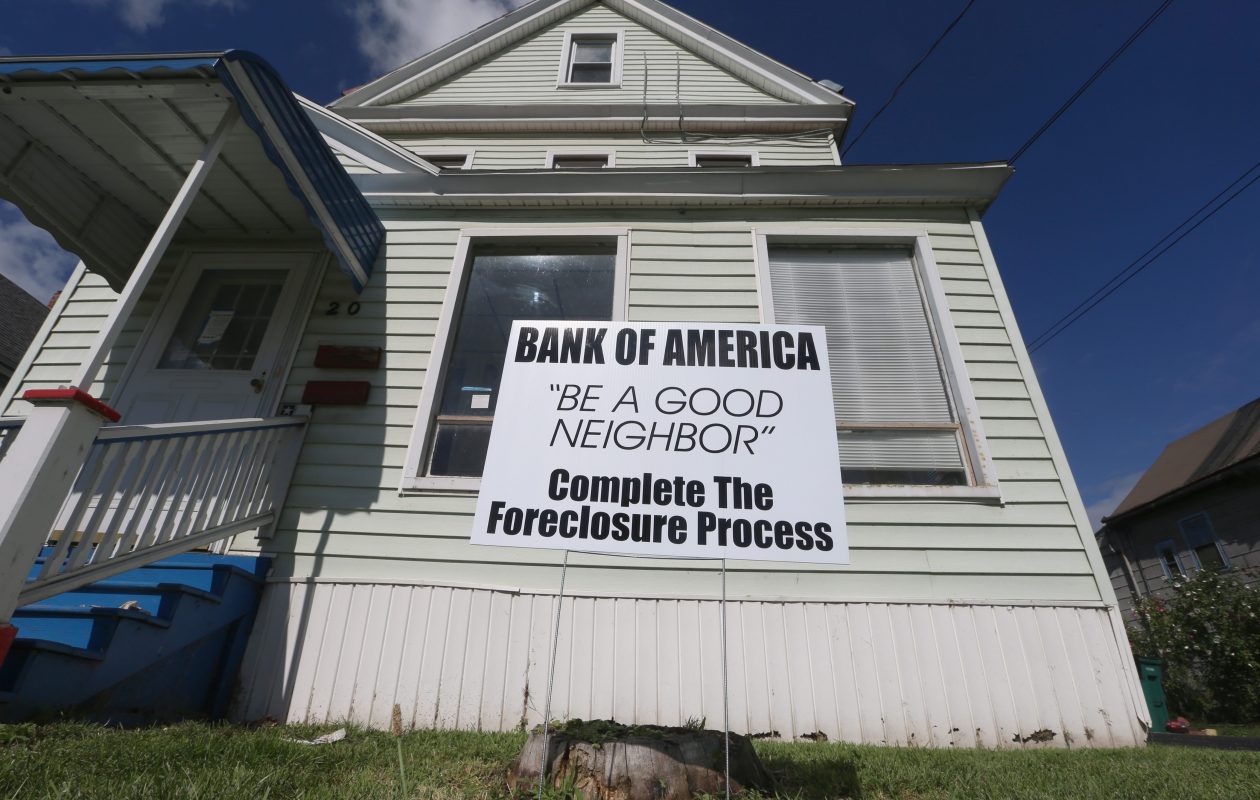

QUEENSBURY | Legislation assuring that purchasers of foreclosed properties rehabilitate their acquired real estate is now under consideration by Warren County leaders.

Warrensburg Supervisor Kevin Geraghty asked members of the county Real Property committee Sept. 27 to contemplate adopting a local law that would require people and corporations buying properties at the county’s annual tax auctions to bring them up to mandated standards within a set period, or face having the real estate revert to county ownership.

Geraghty said that such a law would prevent run-down, dilapidated buildings from sitting for years without being rehabilitated, he said.

“The City of Newburgh requires purchasers of foreclosed properties to bring them up to code within 18 months, and the law works very well for them,” he said.

Geraghty added that Warren County has a substantial number of properties purchased in foreclosure which remain in decrepit condition for years.

“We have problems. Our towns suffer when people buy foreclosed properties and then let them sit without fixing them up. Often we have to chase absentee landlords down,” he said. “A law like this would take care of the blight in our communities.”

The City of Newburgh’s law requires purchasers of foreclosed real estate to bring the properties bought in foreclosure sales into compliance with all state, county and local occupancy standards within 18 months of the date of the deed transfer, or demolish the buildings.

Compliance with this Newburgh city law requires purchasers to produce a local certificate of occupancy — or demolish the building — before the 18-month time period expires.

Under this law, purchasers may seek a three-month extension — with a non-refundable application fee of $250 — to be granted at the discretion of the city manager.

Any subsequent requests for an additional extension need to be submitted to the city council for their consideration.

Geraghty’s suggestion prompted positive responses, and county leaders said they will be reviewing it.

“It sounds like a great idea,” Warren County Administrator Ryan Moore said.

The idea was proposed as the county’s Real Property office is preparing for their annual tax auction.

As of late last week, 30 properties were scheduled to be sold at the auction, set for 10 a.m. Saturday Oct. 20 at the Warren County Courthouse in the county Municipal Center complex off I-87 Northway Exit 20. The properties going up for sale, including a half-dozen homes and dozens of vacant land parcels, represent nearly $1.6 million in market value.

As of Thursday, properties headed for auction include land, homes and other structures in the towns of Chester, Horicon, Johnsburg, Queensbury, Lake Luzerne and Thurman.

At the auction, bidders on properties over $1,000 must be prepared to pay the county 10 percent of the purchase price plus 6 percent buyers’ premium.

Prominent in the roster of properties listed in the auction’s guidebook is the premises of the former Glens Falls Tennis and Seim Club, at 264 E. Sanford St. in Queensbury,

The two parcels in this tax sale, totaling 3.4 acres, have a market value of $224,500.

Warren County Real Property Services Director Lexie Delurie predicted Sept. 27 that the list of land parcels to be auctioned is likely to be reduced as property owners make 11th hour payments to halt the foreclosure process.

Several county residents appeared before the county’s Real Property committee last Thursday to request approval to pay overdue taxes.

Beth Jones successfully made arrangements to pay overdue taxes on her home and adjacent land in Warrensburg, and Paul Unger of Johnsburg also was allowed to pay overdue taxes past the deadline mandated by law.